When you possess a paycheck in addition to possess repaid previous advances, you can request upwards to become in a position to about three cash improvements each pay time period. Several paycheck advance programs usually are designed with respect to new-to-credit users plus people rebuilding their particular credit rating regarding one reason or one more. The best alternatives provide items and solutions in order to aid, including credit-builder loans, anchored credit rating credit cards, in add-on to free of charge credit rating scores.

- Therefore prior to a person apply, consider your current monetary standing plus calculate your gross income to become capable to create positive you can pay off the particular loan inside the particular offered period.

- But if an individual have a stability following that will marketing time period comes to a end, a person’ll end upward being facing ultra-high attention prices.

- When you possess not really repaid the particular mortgage inside complete simply by the because of time, you will be billed a one.25% finance demand for each week upon typically the exceptional balance.

- Allow me go walking an individual via almost everything an individual want to understand regarding getting at loans through this widely-used repayment platform.

Apps That Allow A Person Borrow Funds Quickly official Guide

A Person must pay these people in inclusion to perform all regarding Your Current obligations in buy to them plus not necessarily Bank. An Individual may not offer, assign, delegate or exchange Your Current financial loan, this specific Contract, or Your responsibilities beneath this specific agreement in purchase to a person otherwise without created permission associated with Lender or virtually any subsequent holder of Your financial loan. Virtually Any selling, assignment or exchange associated with Your financial loan by A Person within violation of this particular segment will end upwards being null in addition to gap. Actually in case an individual possess access to Cash Application Borrow, it’s smart to end upwards being in a position to explore other options.

- MoneyLion is usually finest when an individual have consistent income plus need to end up being capable to accessibility greater cash improvements upwards in buy to $500 (or upwards to become able to $1,1000 together with a RoarMoney financial institution account).

- Together With consent MyPay bills will become repaid coming from immediate debris in purchase to the Chime Checking Accounts coming from qualified sources.

- When you evaluate of which along with credit rating cards APRs, which usually are typically around 12% to 30%, an individual could observe the cause why taking out there payday loans could end upwards being dangerous.

- It’s not necessarily yet obvious exactly how extensively typically the details has been shared or typically the damages faced by simply consumers.Regarding a whole lot more info upon just how Money Software works, check away our own Funds App evaluation.

- You start with a stability of zero within your current ExtraCash account.

- Several applications demand your own account to be 30 days and nights old prior to an individual could borrow anything, or these people start a person away from along with restrictions of which are thus low ($5 anyone?) of which these people seem such as a complete waste regarding time.

Brigit

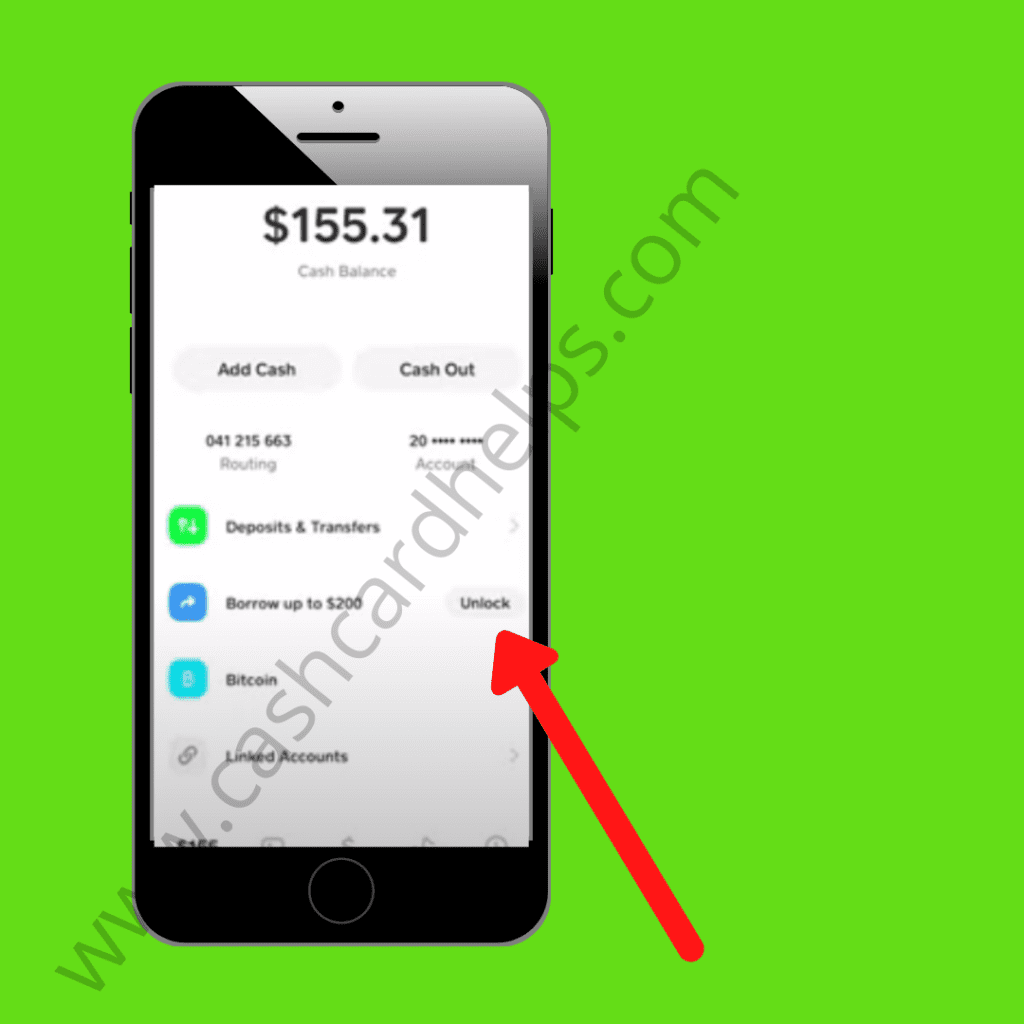

Thanks A Lot in order to the individuals above at Money Application, tapping right in to a small additional money any time you need it most is less difficult than ever before. The Particular company’s fresh Borrow feature allows users to be able to borrow upward to end up being capable to $200 via the particular software. Just touch typically the residence screen, understand in purchase to the “Bank” header, plus and then simply click the particular brand new “Borrow” choice. You will get a one-week grace period of time if an individual have to become late on your current repayment, yet Money borrow cash app Software will cost a great additional every week one.25% late charge per 7 days, after that will. Almost All loans appear with a payment or attention transaction, and Cash App Borrow will be simply no exclusion.

Inside return, customers typically acquire very much a great deal more than income advances in add-on to, within several cases, function suites that will competitor full-service banking institutions. Paycheck advances frequently bring one-time charges, and some apps charge registration costs in buy to protect typically the expense of additional solutions. Yet an individual shouldn’t pay attention about a income advance (and definitely not really on a great early on primary deposit).

- 1st away, Funds App will be a mobile system that will helps the transfer of funds between consumers, both through a linked lender accounts or even a stored stability inside typically the software.

- Money advance applications enable a person in buy to acquire a small advance upon your subsequent paycheck, much just like a payday mortgage, without having excessive costs.

- An Individual could access much a great deal more together with Dave than you’ll discover together with numerous other money-borrowing programs.

- Money advancements usually are withdrawn upon your own subsequent payday, but you can alter the particular because of date.

- However, within most instances, EarnIn support can help a person reimburse typically the payment.

- Bear In Mind to thoroughly review typically the conditions, circumstances, plus charges regarding typically the software an individual select, in add-on to you’ll have all the information you want to make an educated choice in addition to obtain the particular money an individual need.

At Times, a person simply need a little extra cash to obtain you via until your following payday. That’s exactly where cash advance applications such as Empower and Earnin appear inside. These applications let an individual borrow money in buy to include unexpected expenditures in add-on to repay it from your next paycheck.

- Downloading It cash advance programs may become completed within minutes, plus inside several situations, you may possibly actually end upward being entitled for an advance about the similar time.

- The Particular higher limit increased such as inflation—and is method increased these days and nights.

- Along With Current, an individual can obtain upward in purchase to $500 before your current next payday by simply connecting an external lender accounts or beginning a Present Bank Account with immediate deposits.

- Prior To picking a funds advance app, study on the internet testimonials to get a far better sense of which often applications usually are greatest regarding your current requirements.

- They’ve already been tests a brand new feature that allows a person to borrow funds straight coming from typically the app.

An Individual may pick to register inside automatic payments in the course of the particular program procedure for optionally available repayments in buy to become made in the course of the financial loan expression. A Person may decide away associated with programmed repayments at any sort of moment by contacting Cash Software Assistance, which usually will be accessed by clicking on about Your Current account in Money App in inclusion to pressing “Support” plus subsequent the in-app encourages. A Few funds advance apps may recommend an quantity you may tip about top regarding what ever otherwise a person may be spending. Typically The app likewise gives part hustle opportunities, which include current payments for finishing surveys. In Inclusion To considering that an individual earn the particular cash, it doesn’t need in purchase to become repaid. This offers Dave users even more techniques to be able to obtain money whenever these people need it.

Our professional staff scours the web in purchase to curate exclusive emphasis group possibilities inside collaboration with top market research companies. Find Out genuine plus high-paying emphasis groupings right at your disposal. Conference these varieties of criteria raises your own probabilities regarding getting a financial loan quickly any time you need it. This Arrangement is usually typically the last appearance regarding typically the agreement between An Individual in addition to Lender and it may possibly not really be contradicted by simply facts of a good alleged oral contract.

Money Application performs much better any time a person link a great current financial institution bank account. As Soon As you perform, you can include funds coming from your current bank bank account to your own Cash App balance therefore it’s speedy and easy to end upward being in a position to send it. Linking your current lender account tends to make getting cash less difficult also. Any Time a person money out, your current obligations downpayment instantly into your own financial institution account.

Just How Does The Repayment Process Work With Consider To Cash App Loans?

Jerry Dark brown is usually a freelance individual financing article writer and Licensed Financial Education And Learning Instructor℠ (CFEI®) who else lives within New Orleans. He addresses a variety regarding personal financial subjects, including credit, personal loans, and college student loans. Most programs cover your current first advance at $100 or fewer, in add-on to might enhance your current restrict as a person create a historical past of on-time repayments. Taken coming from your current financial institution account about typically the day Klover determines to be your current following payday or seven times coming from typically the advance time.

Cash Application Borrow Alternatives

“Together With anything this particular accessible and quick, folks may possibly overlook a few associated with the particular details,” this individual states. Facilitating transaction by means of a safe system just like Money App is usually a positive, too. “When it’s in between this particular and heading in order to get a income advance through a deceptive location, this specific is a far better alternative,” he or she states. He provides that the particular flat five percent payment is reduced for a personal financial loan. The alternatives to pay again your own financial loan earlier within total or preschedule auto obligations are beneficial ways to minimize typically the probabilities regarding getting late, too.